United States Color Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Target Market (Prestige Products and Mass Products), By Distribution (Offline and Online), and United States Color Cosmetics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Color Cosmetics Market Insights Forecasts to 2033

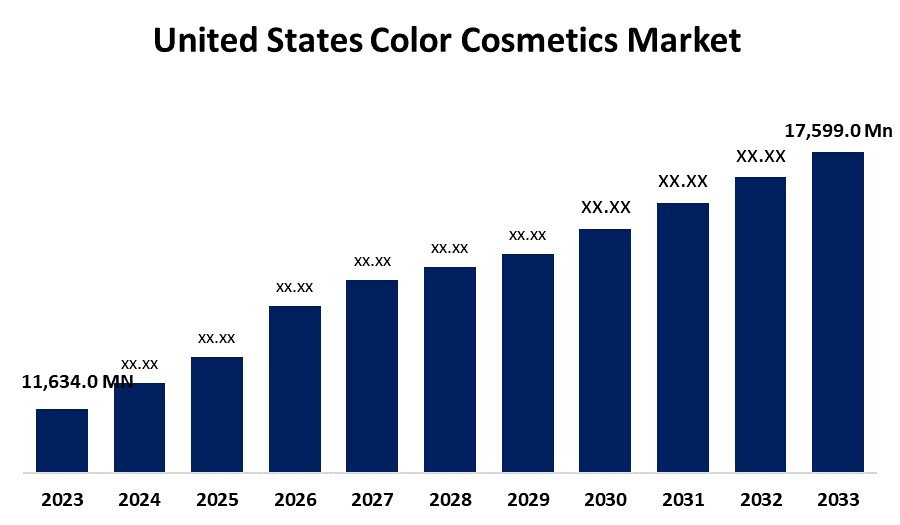

- The United States Color Cosmetics Market Size was valued at USD 11,634.0 Million in 2023.

- The Market is growing at a CAGR of 4.23% from 2023 to 2033

- The United States Color Cosmetics Market Size is expected to reach USD 17,599.0 Million by 2033

Get more details on this report -

The United States Color Cosmetics Market is anticipated to exceed USD 17,599.0 Million by 2033, growing at a CAGR of 4.23% from 2023 to 2033.

Market Overview

The term "color cosmetic" describes colorants and cosmetic compounds used, among other things, in scent, hair care, and makeup. The growing need for face makeup and nail products primarily propels the industry. Additionally, it is predicted that social media's expanding influence will spur market expansion. The key factors expected to drive the US color cosmetics market are rising consumer awareness of the use of color cosmetics, increased concern for appearance, and improved quality of life. The main driver propelling the market's expansion is the rise in internet retailing. The availability of smart devices and the expansion of the Internet have made online shopping platforms more accessible to consumers. The ease of purchasing online and the improved security features of e-commerce platforms are also propelling the market's expansion. Additionally, there is a sizable market for producers and merchants in this nation. These benefits open up favorable channels of distribution for color cosmetics in the US, and they are anticipated to propel market expansion throughout the projected year. The main driver of market expansion in the United States is the increasing demand for face, lip, and hair products. Consumers in the nation are spending more on beauty products as their disposable income rises. The country's beauty and makeup industry has grown thanks in part to the influence of social media influencers and celebrities, which has also helped the expansion of the color cosmetics market in the United States. Color cosmetics demand will rise even more due to a rise in convenience make-up product demand brought on by hectic work schedules.

Report Coverage

This research report categorizes the market for the United States color cosmetics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the color cosmetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the color cosmetics market.

United States Color Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11,634.0 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.23% |

| 2033 Value Projection: | USD 17,599.0 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Target Market, By Distribution and COVID-19 Impact Analysis |

| Companies covered:: | Coty Inc., Estée Lauder Companies Inc., Revlon, Inc., Avon Products Inc., Procter & Gamble, Anastasia, Beautycounter, Blinc, Danessa-myricks beauty, Freck Beauty, Grande cosmetics, and Others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumer awareness of the benefits of organic products has led to a rise in demand in the cosmetics sector for natural and sustainable alternatives. The growing trend of holistic health among consumers has led to a surge in demand for organic color cosmetics. The demand for natural products has increased as a result of increased knowledge about natural products and their benefits. Natural sources of raw materials are being used by cosmetic producers in their compositions. L'Oréal took a move toward partaking in the transformation of the cosmetics sector by introducing a plant-based hair color line called Botanea. Manufacturers are spending more on natural product research and development as a result of the increase in consumer demand for organic products. According to L'Oréal, 95% of the materials used in its product lines and brands will be derived from plants and flowers that can be replenished or replanted, as well as abundantly available minerals during the next ten years.

Restraining Factors

Cosmetic products often use palm oil for texturizing, hydrating, and modifying the viscosity of the product. Climate change, wildlife endangerment, and rapid deforestation are the results of cosmetic makers' increasing demand for palm oil. The destruction of rainforests has resulted in increased temperatures worldwide, altered weather patterns, and the displacement of native populations.

Market Segmentation

The United States color cosmetics market share is classified into target market and distribution.

- The prestige products segment is expected to hold the largest market share through the forecast period.

The United States color cosmetics market is segmented by target market into prestige products and mass products. Among them, the prestige products segment is expected to hold the largest market share through the forecast period. Is probably going to continue to dominate the market for the foreseeable future. The opulent brands offer pricey and high-end makeup items. The increased usage of cosmetics to enhance beauty traits and the impact of movie cultures on consumers has resulted in a growing demand for high-quality products.

- The offline segment dominates the market with the largest market share over the predicted period.

The United States color cosmetics market is segmented by distribution into offline and online. Among them, the offline segment dominates the market with the largest market share over the predicted period. This resulted from consumers' growing inclination to purchase cosmetics from malls, drugstores, and retail establishments where they might inspect the goods before making a purchase.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States color cosmetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coty Inc.

- Estée Lauder Companies Inc.

- Revlon, Inc.

- Avon Products Inc.

- Procter & Gamble

- Anastasia

- Beautycounter

- Blinc

- Danessa-myricks beauty

- Freck Beauty

- Grande cosmetics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, The luxury fashion brand Etro and Coty Inc. announced a new licencing arrangement for the development, production, and distribution of beauty care products. The objective of this collaboration is to broaden the brand's offering in the beauty sector by implementing tactics like knowledge sharing and joint innovation. The stated timescale for this project goes beyond 2040.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Color Cosmetics Market based on the below-mentioned segments:

United States Color Cosmetics Market, By Target Market

- Prestige Products

- Mass Products

United States Color Cosmetics Market, By Distribution

- Offline

- Online

Need help to buy this report?